Planned gifts offer you smart and creative ways to support Coulee Christian – often while benefiting your family, too.

By understanding the available options, you can multiply the results of your generosity in ways that are simple, flexible, cost-effective and powerful.

Giving Stock, Real Estate or Other Assets

You may be able to increase your potential impact –and reduce your taxes – by giving non-cash assets.

Examples of non-cash assets:

Gifts From Your IRA

Individuals ages 70 ½ and older can make a sizable gift from an individual retirement account (IRA) to Coulee Christian and receive significant tax benefits in return.

Gifts in a Will

By including charitable giving in your will, you model to your loved ones a legacy of generosity. You also help ensure Coulee Christian continues to make a difference well beyond your lifetime.

Gifts That Pay You Income

Lifetime income gifts are wonderful solutions for Christians who wish to give in a substantial way, but are concerned about having enough retirement income. You can give cash or other property, and receive steady income for the rest of your life. The remainder will benefit Coulee Christian.

Learn More

Learn how you can multiply the impact of your generosity in smart and powerful ways through our valued partner, Barnabas Foundation. Visit their website to explore giving strategies that align your faith, values, and resources. Call Lacey Wellsfry, Director of Advancement, at 608-786-3004 x2109 or email gro.naitsirhceeluocobfsctd-6afc3c@yrfsllewl for more information.

Coulee Christian Non-Discrimination Policy

Coulee Christian School admits students of any race, color, and national or ethnic origin to all the rights, privileges, programs, and activities generally accorded or made available to students at the school. It does not discriminate on the basis of race, color, and national or ethnic origin in administration of its educational policies, admissions policies, scholarship and loan programs, and athletic and other school-administered programs.

Affording a Coulee Christian Education

Investing in your student’s education is one of the most important investments a parent can make. Coulee Christian School participates in programs that you may be eligible for that would allow your student to attend tuition-free. Other families may qualify for Tuition Assistance. We encourage all families with students in grades K-12 who want to offer their children a Christ-centered education to apply and see how you can invest in your students.

CSS has a robust, need-based financial aid program, and we are confident that we will be able to provide the needed assistance to all families who demonstrate a financial need through our FACTS process. For families that qualify, up to 50% of the tuition could be covered by Financial Aid. See the Tuition & Financial Aid section for more details and to apply.

Special Needs Scholarship Program (SNSP)

The Special Needs Scholarship Program (SNSP) allows a student with academic disabilities, who meets certain eligibility requirements, to receive a state-funded scholarship to attend a participating private school. Students need to reside in the state of WI and have a current IEP or Service Plan to be eligible for this scholarship. Click here to learn more about SNSP.

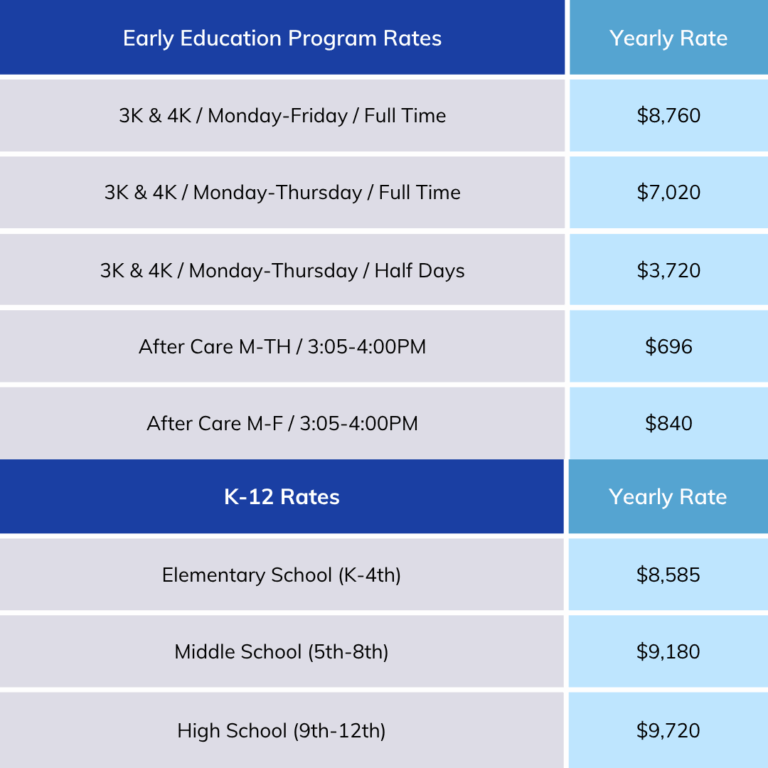

2025-2026 Tuition Rates

A vast majority of our students receive tuition assistance in some form or another, including a multi-student discount. The rates below are for a full-paying student who doesn’t qualify for financial aid. These rates reflect the current school year and are subject to change per the decision of the School Board for the following school year.

There are payment plan options available for 10, 11, or 12 months. (The chart below is based on a 12 month payment plan.) If you desire to pay in full, that payment is due August 1.

Multi student discount:

2 children: 6% – 3 children: 12% – 4 children 24% – 5 or more children: 36%